Principal 401k withdrawal calculator

Term of Loan in Years. Taking a withdrawal from your traditional 401k should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS plus a 10 percent early withdrawal.

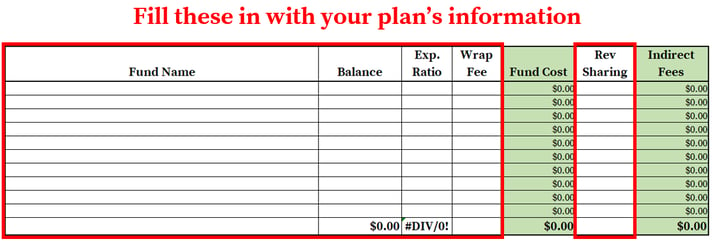

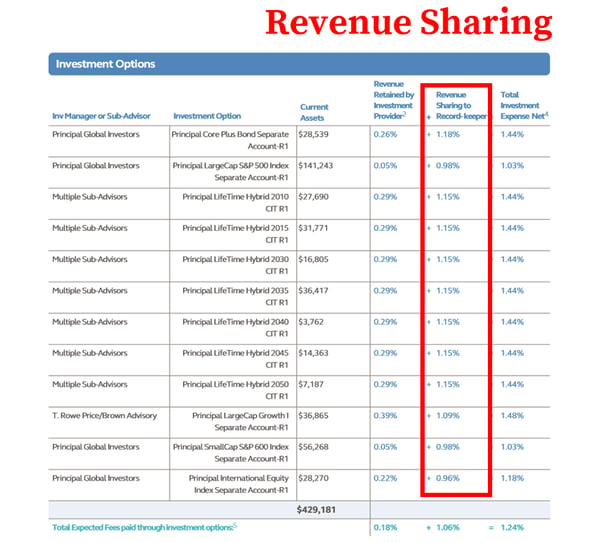

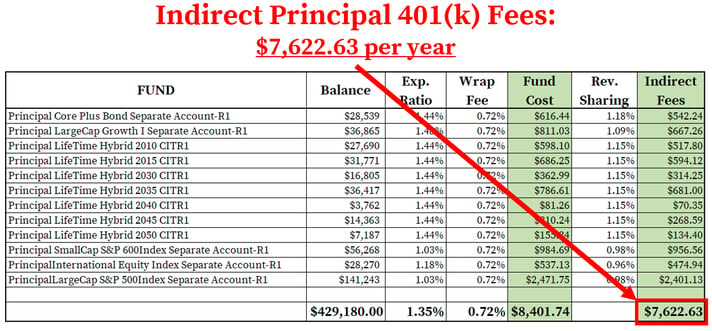

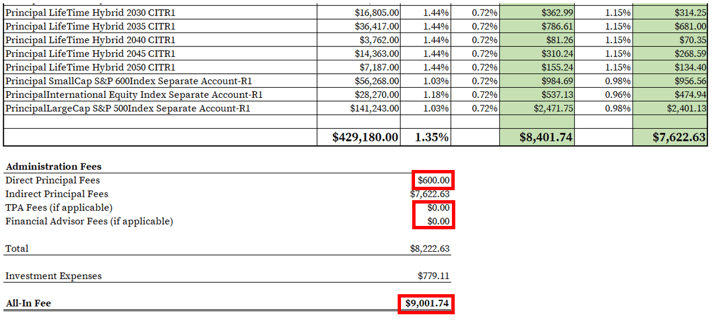

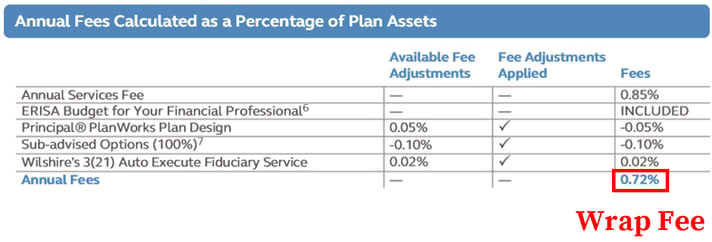

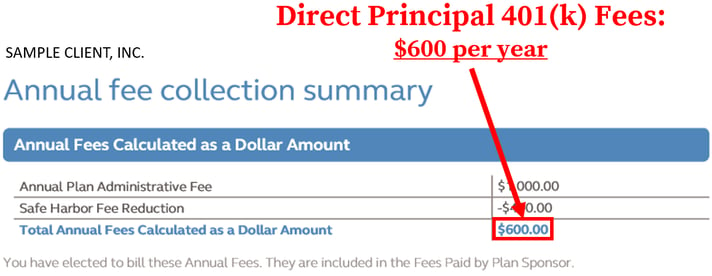

How To Find Calculate Principal 401 K Fees

Whether youve reached retirement age or need to tap your 401k early to pay for an unexpected expense there are various ways to withdraw money from.

. 61000 67500 if youre age 50 or older includes salary deferral amount and employer matches. 401K and other retirement plans. You should consider the retirement withdrawal calculator as a model for financial approximation.

For these reasons this retirement withdrawal calculator models a simple amortization of retirement assets. Principal Financial Group review. Participants should regularly review their savings progress and post-retirement needs.

The 401k has become a staple of retirement planning in the US. I submitted all requested documentation but had my request. Millions of Americans contribute to their 401k plans with the goal of having enough money to retire comfortably when the time comes.

IRAs or 401ks please visit the Retirement Calculator Roth IRA Calculator IRA Calculator or 401K Calculator. I am a veteran attempting to use my VA loan and indicated as such in my request. It is the simplest most straightforward of all possible models by emulating a fixed income bonds and cash portfolio with a progressive amortization of principal until all the assets are spent.

Such as a 401k 403b or governmental 457b. For people under the age of 59½ a hardship withdrawal or early withdrawal from your 401k is allowed under special circumstances which are on the IRS Hardship Distributions pageUsing your 410k for a down payment on a. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

If you return the cash to your IRA within 3 years you will not owe the tax payment. It may be tempting to pull money out of your 401k to cover a financial gap. This calculator only provides education which may be helpful in making personal financial decisions.

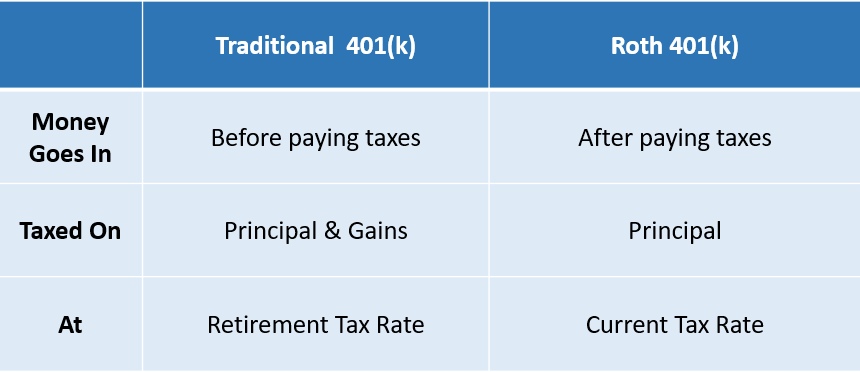

You make pre-tax contributions and pay tax on withdrawals in retirement. Hedging and protective strategies generally involve. Costs related to the purchase of a principal residence.

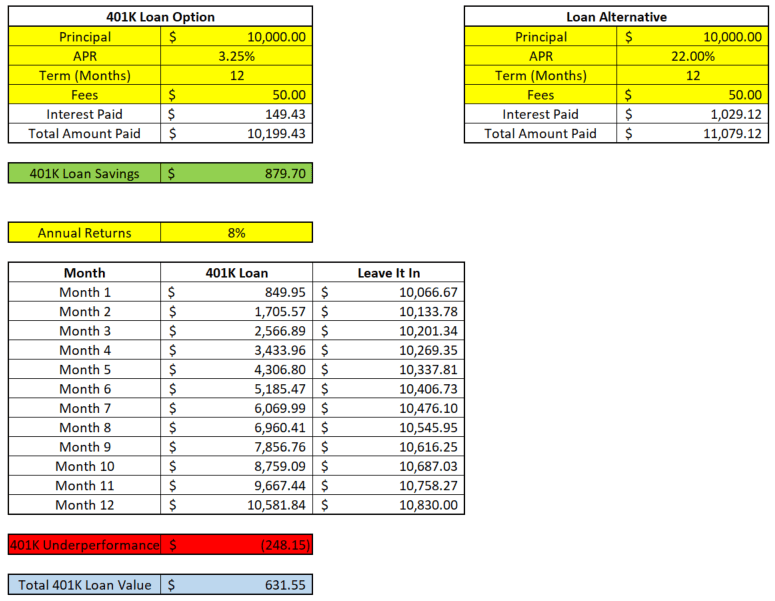

This calculator assumes a fixed interest rate and the interest is compounded each period. Instead we look at spending needs and we can check on the withdrawal rate later. Funds are added directly to your 401k account.

Rob Daniels of US. If your employer does not offer 401k loans they may still offer a 401k withdrawal. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

Use our 401k Early Withdrawal Costs Calculator first. Systematic withdrawals keep your principal invested through the whole period of your expected retirement. Or when you are considering rolling money over from a 401k to an IRA you may wish to roll over only a portion of your retirement savings and take the rest in cash.

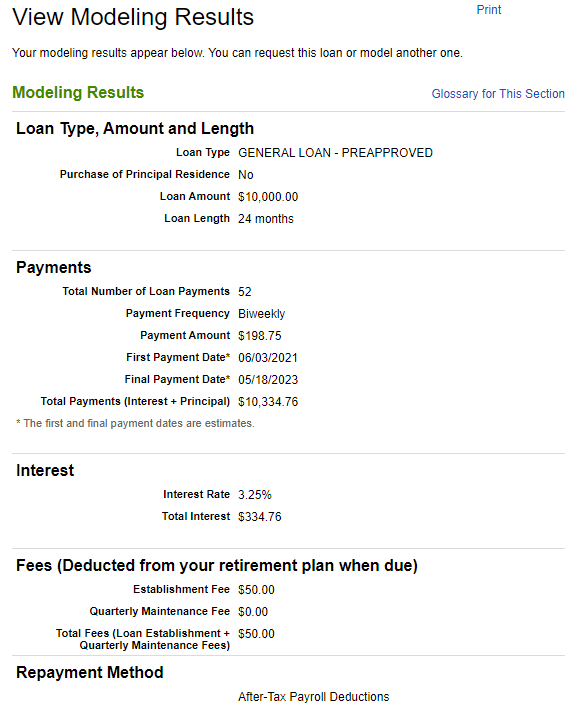

Aug 18 2022 236 pm EDT. Withdrawal Rules Roth IRA Roth IRA Account What is a Roth IRA. I submitted a 401k Loan request for new home purchase.

Individual results will vary. Responsibility for those decisions is assumed by the participant not the plan sponsor and not by any member of Principal. Auto loans are usually between 2 and 5 years.

All payment figures balances and interest figures are estimates based on the data you provided in the specifications that are despite. Including the amount of the cash withdrawal from your retirement plan. 20500 27000 if youre age 50 or older.

TD Ameritrade Solo 401k Loan Provisions. Mortgage loans usually have 15 or 30-year terms. The rule of 55 lets you withdraw penalty-free from your 401k or 403b before you reach age 595 - but only under certain circumstances.

Some fields are incomplete or the information is incorrect. Total contribution limits for 2022. Early Withdrawal Costs Calculator.

Free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. If you retire with 500k in assets the 4 rule says that you should be able to withdraw 20000. Investing involves risks including loss of principal.

How to Rollover a 401K Inherited IRA Inherited IRA Account Withdrawal Rules Custodial IRA Education and Custodial Overview College Savings Calculator 529 Savings Plan. Note that when I work with clients we dont start with a withdrawal rate. Early 401k withdrawals will result in a penalty.

Salary deferral limits for 2022. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your 401k. This is the amount that is paid each period including both principal and interest PI.

If you left your employer in. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. But do you know the true cost.

Or early withdrawal penalties implemented by the IRS reduce liquidity.

How To Find Calculate Principal 401 K Fees

Making A Choice For Your 401 K Principal

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Making A Choice For Your 401 K Principal

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

Traditional Vs Roth 401 K Which One Should You Choose

Introducing Simply Retirement By Principal Ubiquity

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

2

Bond Price Finance Apps Tax App Financial Calculator

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Catch Up Contributions How Do They Work Principal

How To Find Calculate Principal 401 K Fees